What makes up the price of fuel at Certa?

- September 1, 2022

We spend a lot of money every year filling up!

Few, if any of us, can accurately recall the price of a litre of petrol or diesel. Not helped by the fact it varies from petrol station to station.

So why do prices go up and down and can consumers cushion themselves against the vagaries of the industry?

Here’s a simple guide outlining what determines the price of fuel:

- Petrol and Diesel prices are particularly responsive to decisions about output made by OPEC, the Organization of Petroleum Exporting Countries which operates as a cartel.

- Like any product, the laws of supply and demand influence prices; and petrol and diesel prices are priced on international markets.

- Exchange rates have an impact. Petrol & Diesel is priced and traded in dollars so if there are movements in the exchange rate between the euro and the dollar, it will cause price fluctuations.

- Natural disasters disrupt production, and political unrest in an oil-producing juggernaut like the Middle East will cause pricing fluctuations.

But really Tax is the big one!

All very interesting but really what happens thousands of miles away in the Middle East is only part of the story. What happens closer to home is what really drives prices up. Tax is by far the single largest component of the pump price. More than half of the petrol price goes to the Government.

- Take excise tax: per litre, 54.18 cents for petrol and 42.57 cents for diesel.

- Next up the NORA levy: this levy funds the National Oil Reserves Agency and accounts for 2.00 cent per litre for both diesel and petrol.

Carbon tax: per litre, costs 4.59 cents for petrol and 5.33 cents for diesel. - Biofuel obligation: The State obliges oil companies to ensure that 6% of their volume of all motor fuels is from renewable sources such as ethanol or biodiesel. The net effect currently is to add about 1.5 cents to a litre of petrol and about 3 cents to a litre of diesel – (to both of which VAT is added at 23%).

- Better Energy Levy: 0.12 cents per litre.

- VAT: 23% on all the above.

As a proportion of the petrol price, Irish motorists pay some of the highest taxes in Europe. Around 77c is added to every litre of petrol purchased. That’s over half the price of a litre going back to the government for investment in roads, infrastructure projects etc.

And finally, the mark up at the pump!

The mark up fuel providers charge covers their cost of transporting fuel to site, other operating costs, technology deployed and investor returns. Margins on fuel are very tight. That’s why many forecourt operators operate shops to recoup back profit. Prices can vary from suburb to suburb, town to town but this is dependent on the level of costs that each site needs to cover.

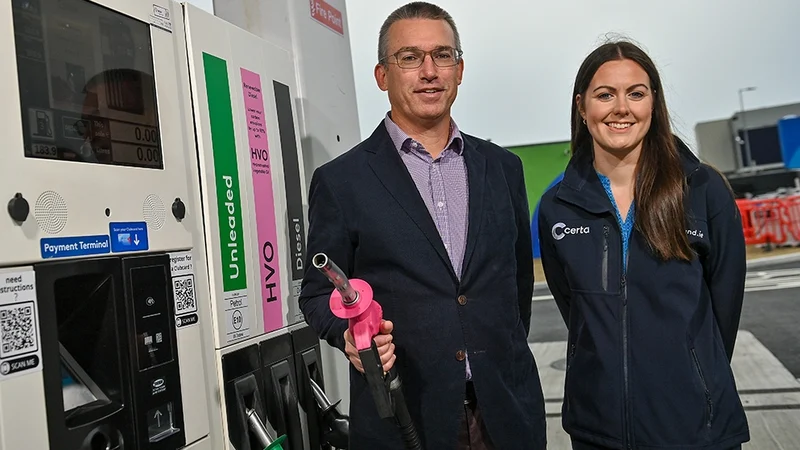

How does Certa maintain its value promise?

At Certa we’ve built a fully automated network of unmanned filling stations. Our site operating costs are lower as a result. And part of our commitment to our customers is to endeavour to always be the cheapest fuel provider around.

To help make this a reality we’ve a dedicated team of pricing analysts who monitor prices across the entire competitor landscape, and endeavour to offer the most keenly priced our pricing is the most keenly and most competitively available.

Find one of our petrol stations closest to you, or if for whatever reason our prices aren’t the cheapest in your area, drop us a mail on [email protected].

We’ll check it out immediately and get back to you.

Safe journeying – enjoy the ride.